US citizens and resident aliens are not the only individuals potentially subject to US federal income taxation. In certain situations, US non-resident aliens have US tax and filing obligations, as well.

A person who is not either a US citizen or national and does not meet either of the IRS tests to be considered a US resident alien is regarded as a non-resident alien.

The two tests to be considered a US resident alien for US tax purposes are as follows:

The Green Card Test

The Substantial Presence Test

The Green Card Test

A non-US citizen or national who possesses a US Green Card.

The Substantial Presence Test

A non-US citizen or national who meets the Substantial Presence Test.

The Substantial Presence Test is met if someone is physically present in the US for either at least 31 days during a tax year or 183 days during a three consecutive year period, counting –

There are a few exceptions to the non-resident classification—daily commuters from Mexico or Canada and some international students and teachers — to name a few.

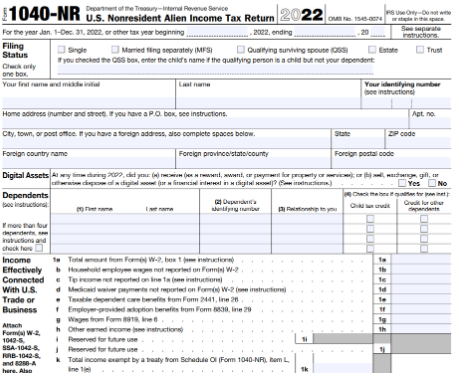

Non-resident aliens file their US returns on Form 1040-NR, US Non-resident Alien Income Tax Return, and only report income earned or derived from US sources on the return. While wage income is usually taxed at the same graduated rates applicable to US citizens and resident aliens, portfolio income such as interest, dividends, and capital gains is generally taxed at a flat 30% rate.

In some cases, a lower rate is applicable via an income tax treaty with the non-resident alien’s home country.

Yes, an individual can be both a resident alien and a non-resident alien in the same tax year if they meet the substantial presence test during the year and arrive in or depart from the US part-way through a year. Individuals who fit that scenario are classified as dual-status aliens.

For example, if they begin their US tax residency in 2023, they must file their 2023 US returns on Form 1040 with a Form 1040-NR attachment. If they end their US tax residency in 2023, they will file their returns on Form 1040-NR with a Form 1040 attachment. Income reported on Form 1040-NR will only be US-source income for the non-resident period, while income reported on Form 1040 will include the worldwide income for the resident period.

Green card holders are usually classified as dual-status aliens in the year in which they first receive their green cards, as well as in the year their green cards are revoked.

Universal Tax Professionals’ team of CPAs and IRS Enrolled Agents are experienced in navigating the US filing requirements for US non-resident aliens and US dual-status aliens.