For US citizens living abroad, filing a US tax return involves more than just completing Form 1040. To help reduce the burden of double taxation, US expats can use Form 2555 to claim the Foreign Earned Income Exclusion (FEIE), allowing them to exclude a certain amount of foreign-earned income from US taxation.

Claiming the FEIE can significantly reduce your US tax liability, but it’s important to know how to properly claim it. If you need assistance with expat tax preparation, Universal Tax Professionals is here to help ensure that you correctly claim this exclusion on your tax return and minimize your tax burden.

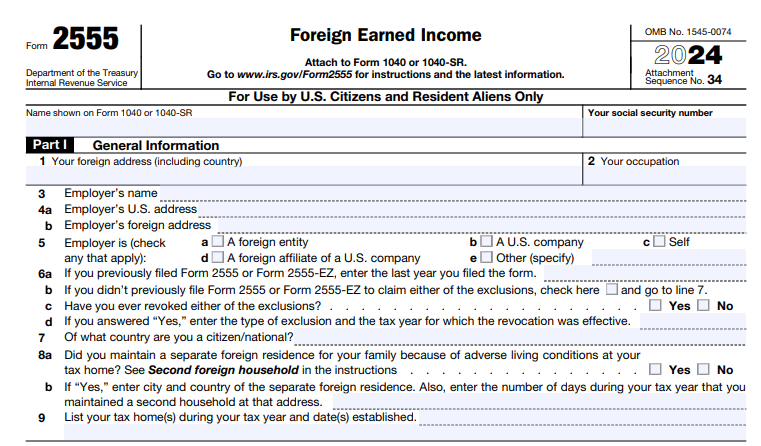

What is Form 2555?

IRS Form 2555 is used by US citizens and resident aliens who meet the qualifications to exclude their foreign-earned income from US tax. The form is required to claim:

Foreign Earned Income Exclusion (FEIE): This allows you to exclude a certain amount of foreign-earned income from your taxable income. For the tax year 2023, the exclusion amount is $120,000 per qualifying person (this figure adjusts annually for inflation).

Foreign Housing Exclusion or Deduction: This can exclude or deduct certain housing expenses you incur while living abroad. These include rent, utilities, and other necessary living expenses, up to specified limits, based on the city or country where you reside.

To use Form 2555, you must meet one of two tests:

- The Physical Presence Test: Spending at least 330 full days in a foreign country during a 12-month period.

- The Bona Fide Residence Test: Being a resident of a foreign country for an entire tax year (usually determined by your intentions and circumstances).

If you qualify under either test, you can use Form 2555 to claim these exclusions.

How to fill out Form 2555?

Filling out Form 2555 involves several steps. Below is a breakdown of the form and the critical sections you’ll need to complete.

Step 1: Part I – General Information

This section asks for basic details about your foreign income situation:

- Your Name and SSN: As with most IRS forms, you’ll need to provide your name and Social Security Number (SSN).

- Tax Year: Indicate the year for which you’re filing the form.

- Foreign Address: You will need to enter your foreign address, including the country where you reside.

Step 2: Part II – Qualifying for the Exclusion

In this section, you’ll demonstrate how you meet the eligibility requirements for the Foreign Earned Income Exclusion.

If you are applying for the exclusion based on the Physical Presence Test, you will need to provide specific dates of when you were present in the foreign country. If using the Bona Fide Residence Test, you must explain your situation to show that you lived abroad for the entire tax year and established residence in a foreign country.

Step 3: Part III – Foreign Earned Income

This section requires you to list your foreign earned income, which may include:

- Wages or salary earned from working for a foreign employer.

- Self-employment income earned abroad.

- Certain foreign allowances or reimbursements from your employer, such as housing allowances.

Make sure to include only income earned while living and working abroad and exclude income earned while temporarily in the US. You’ll enter the total amount of foreign-earned income in this section, which will be subtracted from your taxable income.

Step 4: Part IV – Foreign Housing Exclusion or Deduction

If you’re eligible for the Foreign Housing Exclusion or Housing Deduction, this section allows you to report qualifying housing expenses, such as:

- Rent for your foreign residence.

- Utilities, such as electricity and water.

- The cost of certain goods and services necessary for maintaining a foreign residence (e.g., repairs, cleaning).

The IRS allows a certain percentage of these expenses to be excluded from your taxable income, subject to specific limits based on your location and the amount of housing costs you incurred. The Housing Exclusion is typically more beneficial, as it directly reduces your taxable income.

Step 5: Part V – Housing Costs Limitation (for Exclusion or Deduction)

This section helps you calculate the maximum amount you can exclude or deduct for housing expenses. The IRS provides limits on housing costs depending on your location, with the highest exclusions typically available for expensive cities like Tokyo or Paris. Keep in mind that the Foreign Housing Exclusion does not apply to taxpayers living in certain low-cost countries, and any unused housing deduction may be carried forward to subsequent years.

Step 6: Complete Form 1040

Once you’ve filled out Form 2555, the next step is to file it along with your Form 1040. The income exclusions and deductions you’ve calculated on Form 2555 will reduce your taxable income, and you’ll file your taxes just like any other individual taxpayer.

How to submit Form 2555?

After completing Form 2555, you need to submit it with your annual tax return (Form 1040). You can file both forms electronically using e-filing services, or you can file them by mail. The IRS recommends e-filing, as it is faster and provides confirmation that your return has been processed.

When is the deadline to file Form 2555?

The deadline for filing your tax return, including Form 2555, is April 15 for most taxpayers. However, if you are living abroad, you automatically receive an extension until June 15 to file your taxes. If more time is needed, you can request an additional extension until October 15.

Tips for Filling Out Form 2555

- Keep detailed records: Be sure to maintain accurate records of your travel, including entry and exit dates for the countries where you reside. This will help support your claim for the Physical Presence Test or Bona Fide Residence Test.

- Foreign Housing Exclusion Limits: If you plan to claim the Foreign Housing Exclusion, make sure to track your housing expenses closely, as there are limits on how much you can exclude. IRS guidelines will provide the specific amounts based on the location of your foreign residence.

- Include all necessary forms: If you are claiming the Foreign Housing Exclusion or Deduction, you may need to fill out an additional form (such as Form 8889 for Housing Costs). Ensure that you include all necessary forms for a complete submission.

Form 2555 is a valuable tool for US expats looking to minimize their US tax liability by claiming the Foreign Earned Income Exclusion and possibly a Housing Exclusion or Deduction. By following the guidelines in this form, you can ensure that your foreign-earned income is excluded from US taxation, thus avoiding double taxation. Be sure to meet the necessary eligibility tests and fill out the form carefully to benefit fully from its provisions. If you’re unsure about how to complete the form or whether you qualify for the exclusions, feel free to contact Universal Tax Professionals.