For Americans living overseas, filing a US expat tax return can feel overwhelming. Whether you’ve relocated for work, family, or adventure, staying compliant with US expat taxes is crucial. The US tax system operates on a citizenship-based taxation principle, which requires all US citizens and green card holders to report their worldwide income. This means that your US tax obligations remain, even if you live and work in another country.

Unlike most other countries, the US taxes its citizens and green card holders on worldwide income, even if it’s earned abroad. As an American expat, you are still subject to the same tax rules as those living in the US. This means you must file a US expat tax return and meet your US tax obligations if your global income exceeds the annual filing thresholds for your status:

Single filers: $14,600

Married Filing Jointly: $29,200

Married Filing Separately: $5

Head of Household: $21,900

Self-Employed: $400

Even if you never set foot in the US during the year and earned all of your income abroad, you still must file a US tax return and pay taxes on your US taxable income if your income exceeds the minimum filing threshold. This includes not only your wage or self-employment income but also interest, dividends, capital gains and rental income, regardless of where the income was sourced—US or foreign.

US expat tax preparation involves more than simply filing a tax return. It requires careful consideration of your income, location, and eligibility for special exclusions and credits designed to help Americans living abroad avoid double taxation. Here are the key components of preparing a US expat tax return.

At the heart of US expat tax preparation is IRS Form 1040, which every US citizen, regardless of location, must file annually.

This form is used to report all sources of income, both from the US and abroad. For Americans living abroad, Form 1040 is supplemented by additional forms that allow you to claim exclusions and credits to reduce your tax liability. Failing to file this form can lead to penalties, even if you owe no taxes, so it’s essential to ensure it’s completed correctly.

One of the most significant benefits available to US expats is the Foreign Earned Income Exclusion (FEIE), which allows you to exclude up to a certain amount of foreign-earned income from US taxation. For the 2024 tax year, this exclusion is up to $126,500 per individual.

Claiming the FEIE is essential to reducing your US expat tax burden, especially if you’re working and earning income abroad. The exclusion is claimed using Form 2555, which must be attached to your US expat tax return.

If you pay taxes to a foreign government on your income, you can also benefit from the Foreign Tax Credit (FTC). This credit allows you to offset your US tax liability by the amount of taxes paid to a foreign country. This is especially useful for Americans living in countries with higher tax rates than the US, as it can prevent double taxation on the same income.

To claim the FTC, you must file Form 1116 along with your US expat tax return. It’s important to calculate your foreign taxes accurately and ensure that the credit is applied correctly to avoid overpaying or underpaying taxes.

The standard deadline for filing US tax returns is April 15th. However, for Americans living abroad, an automatic extension is granted, allowing them until June 15th to file their returns. For the 2024 US tax return, which needs to be submitted in 2025, the US tax deadline for Americans in the US is on April 15, 2025. Meanwhile, Americans living abroad have an automatic two-month extension allowing them to submit the 2024 US tax return until June 16, 2025.

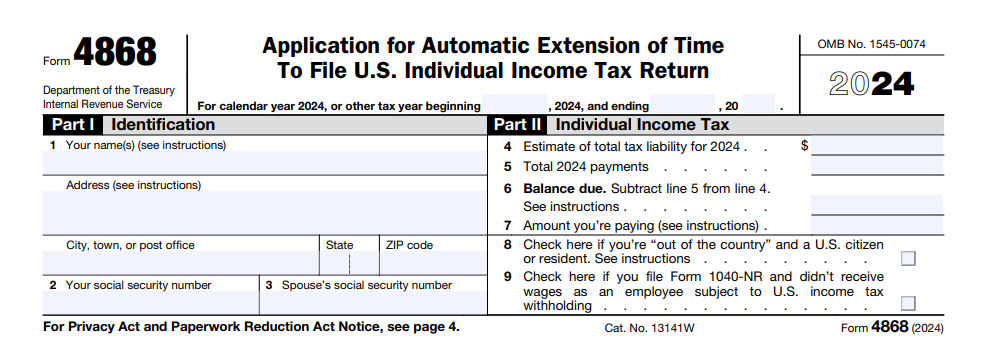

If further time is needed beyond the automatic extension, US expats can request an additional extension. This additional extension is obtained by filing IRS Form 4868, “Application for Automatic Extension of Time To File US Individual Income Tax Return.” This form grants an additional extension of up to four months, moving the filing deadline to October 15th.

However, it’s important to remember that this extension only applies to the filing of the tax return itself. Any tax liability must still be paid by the original April 15th deadline to avoid penalties and interest.

Understanding and managing US tax obligations while living abroad is essential for American expatriates. By staying informed about residency status, filing deadlines, available exclusions and credits, and reporting requirements, expats can navigate the tax landscape with confidence. Seeking professional advice can further enhance compliance and help optimize tax outcomes, ensuring financial peace of mind for those living far from home.

Here at Universal Tax Professionals, our team of CPAs and IRS Enrolled Agents specialize in providing a wide range of US expat tax services. We are ready to handle all of your US filing obligations and help minimize your worldwide tax burden, no matter where in the world you are.

Our team consists of experienced accountants, not automated software. You’ll have access to real professionals who can handle even complex US expat tax returns.

You can directly speak with your dedicated accountant via email or phone to address any questions or concerns, ensuring you receive tailored advice specific to your tax situation.

As part of our service packages, we offer not only tax preparation but also strategic tax planning to help your minimize your tax burden.

Our service extends beyond just filing your taxes. We are here to assist you with any tax-related matters throughout the year, providing ongoing guidance and support.

Yes. US citizens and Green Card holders must file a US tax return each year, even if they live overseas or pay taxes in another country.

You still need to file a US tax return, but in most cases, you won’t owe additional US tax. The US offers benefits like the Foreign Earned Income Exclusion and the Foreign Tax Credit, which typically reduce your US tax owed to zero.

Yes. We can help you catch up through the IRS Streamlined Filing Compliance Procedures, which allow expats to become compliant without penalties if the failure to file was non-willful.

You can make payments directly to the IRS through options like IRS Direct Pay, or international wire transfers. We’ll guide you through the best and easiest method for your situation.

We’re here to make the process simple and stress-free. When you work with Universal Tax Professionals, you’ll be paired directly with an experienced accountant who specializes in US expat taxes and not just automated software.

Your expat tax accountant will personally review your situation, ensure you claim every possible exclusion and credit, and answer all your questions along the way. You can also schedule a call with us to discuss your tax needs and make sure you’re getting the highest quality of US expat tax service from start to finish.