Foreign exchange (forex) trading is one of the largest financial markets in the world, attracting both casual traders and full-time professionals. While traders often focus on strategies, platforms, and profits, one critical area is sometimes overlooked—forex tax reporting. Whether you trade currencies part-time or as your primary income source, the IRS and tax authorities worldwide require you to properly report your gains and losses.

At Universal Tax Professionals, we provide US expat tax services to help Americans abroad report all types of income, including investment and trading income, such as forex profits. Whether you are living overseas temporarily or permanently, our team ensures your forex earnings are accurately filed with the IRS and in line with US tax laws.

Key Summary: Forex Tax Reporting

-

Forex trading profits are taxable for US citizens and residents, even if the trading occurs overseas or through foreign brokers.

-

Forex gains are usually taxed under Section 988 (ordinary income) or Section 1256 (capital gains), depending on how the trades are classified.

-

Exchange rate fluctuations affect the taxable amount when converting foreign income or account balances into US dollars for IRS reporting.

-

US expats must report forex income annually, along with other international reporting requirements such as FBAR and FATCA, to stay compliant with IRS rules.

What is Forex Tax Reporting?

Forex tax reporting refers to the process of disclosing your trading activity in the foreign exchange market on your tax return. This includes recording profits, losses, and related expenses according to the rules set by the IRS.

The complexity arises because forex trading can be taxed under different sections of the Internal Revenue Code, depending on how you trade and the elections you make. Most traders fall under either Section 988 (ordinary gains and losses) or Section 1256 (capital gains and losses).

Why is Forex Tax Reporting Important?

Failing to properly report your forex trading activity can lead to IRS penalties, audits, and unnecessary tax bills. Some of the key reasons accurate forex tax reporting matters include:

- IRS Compliance – The IRS requires taxpayers to report all income, including forex gains.

- Tax Savings Opportunities – Choosing the right tax treatment (988 vs. 1256) can reduce your tax liability.

- Record-Keeping for Losses – Losses can sometimes offset other taxable income.

- Transparency for Active Traders – If trading is your primary income source, the IRS expects detailed reporting.

Working with a company that specializes in American tax services can help ensure your forex profits and losses are accurately reported, no matter where you live.

Forex Tax Reporting Rules: Section 988 vs. Section 1256

One of the most common questions traders ask is: How are forex trades taxed? The answer depends on whether your activity falls under Section 988 or Section 1256 of the Internal Revenue Code.

Section 988 – Default Rule for Forex Trading

Under Section 988, most forex spot trades are taxed as ordinary gains and losses rather than capital gains. This means all profits are taxed as ordinary income at your marginal tax rate, which ranges from 10% to 37% in 2025. One advantage of Section 988 is that losses can be fully deducted against other types of income, which can provide relief in a losing year.

However, there are no preferential rates available, everything is taxed as regular income, making this the simplest but sometimes the least favorable option for consistently profitable traders.

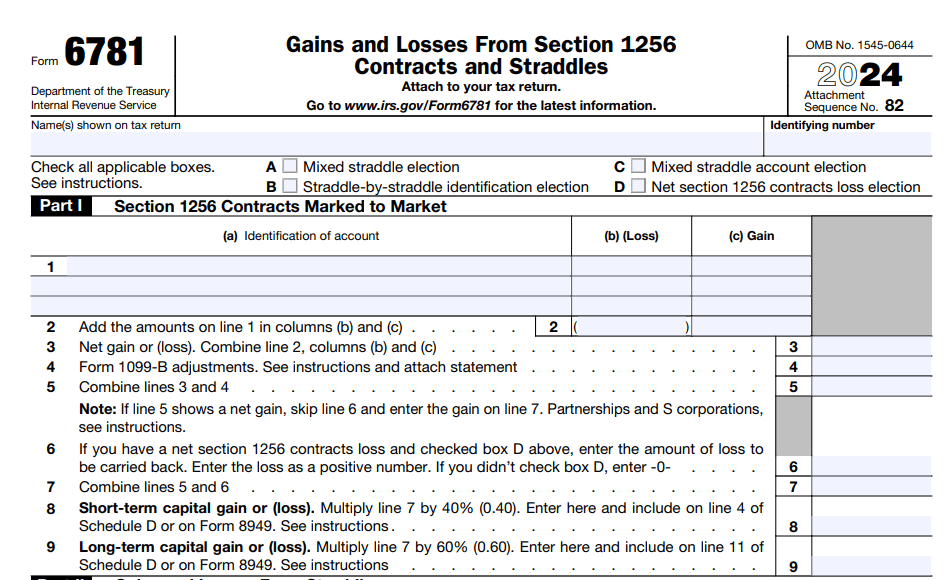

Section 1256 – 60/40 Tax Treatment

Section 1256 applies to certain regulated futures and options contracts, including some forex contracts, and offers more favorable tax treatment. Under this rule, 60% of gains are taxed at the long-term capital gains rate (up to 20%), while the remaining 40% are taxed at your ordinary income rate. This blended method often results in a lower overall tax bill for traders who generate steady profits. However, electing Section 1256 treatment requires a capital gains election to move forex trades under this category.

Most retail forex spot traders fall under Section 988 unless they elect to use Section 1256. The election must be made by the first day of the tax year (January 1).

Short-Term Gains in Forex Trading

The majority of forex traders realize short-term gains because positions are rarely held for more than a few days. Unlike stocks, where long-term capital gains treatment applies if you hold an investment for over a year, forex trading does not distinguish between long- and short-term positions in the same way. For most traders, all gains are considered short-term and are taxed according to the method chosen at the beginning of the tax year.

If you remain under the default rules, your short-term forex gains are treated as ordinary income and taxed at your individual income tax rate. For traders with steady profits, this can mean a higher tax bill since rates may reach up to 37% depending on your tax bracket. On the other hand, if you elected the alternative tax treatment, short-term forex gains benefit from blended rates, where part of the profit is taxed more favorably.

The key takeaway is that almost all forex profits count as short-term gains, regardless of how long you hold your positions. This makes it especially important for active traders to plan ahead, understand which tax rules they fall under, and consider how frequent trading could affect their overall tax liability.

Need Help Reporting Your Forex Income?

Get expert help to ensure your forex profits and losses are reported accurately and in full compliance with tax rules.

How to Report Forex Income on your US Taxes

Proper forex tax reporting requires careful record-keeping and accurate filing. Here’s a step-by-step breakdown:

1. Keep Detailed Records

The IRS requires traders to maintain records of all trades, including:

- Date of each transaction

- Currencies traded

- Profit or loss from each trade

- Broker statements

- Related expenses (software, subscriptions, etc.)

2. Identify Your Tax Treatment

Forex traders must determine how their gains and losses will be taxed for the year. By default, transactions fall under Section 988, where profits and losses are treated as ordinary income or loss.

However, traders can elect Section 1256 treatment, which allows certain contracts to be taxed under the 60/40 rule. Making this decision early is important since it directly affects how your trading results will be reported to the IRS.

If you are living overseas, say, you’re an American residing in the UK, you may also need to consider US expat taxes in the UK. In that case, it’s best to work with a professional who provides expat tax advice to ensure both your UK and US tax obligations are handled correctly. Since your forex gains may also need to be reported to HMRC in the UK, there’s a possibility of being taxed by both countries on the same income. However, you can often claim a Foreign Tax Credit (FTC) on your US return to offset taxes already paid to the UK, helping you avoid double taxation.

3. Use the Correct IRS Forms

- Section 988 Reporting: Report your net gains or losses as “Other Income” on Schedule 1 (Form 1040).

- Section 1256 Reporting: File Form 6781 (Gains and Losses from Section 1256 Contracts) to apply the 60/40 tax treatment.

- Foreign Accounts: If you hold forex accounts with foreign brokers and your combined balance exceeds $10,000 at any time during the year, you must file an FBAR (FinCEN Form 114) to stay compliant with IRS reporting rules.

4. Consider Deductions

Expenses related to forex trading may be deductible, including:

- Trading platform fees

- Data feeds and charting software

- Professional tax preparation costs

- Education and training (if you qualify as a trader, not just an investor)

5. File on Time

The standard IRS filing deadline is April 15 (or October 15 with an approved extension). Expats living abroad automatically receive an additional two months, until June 15, with the option of requesting a further extension to October.

If you live outside the US and trade forex, working with an expat tax specialist can give you peace of mind that your returns are accurate, complete, and compliant with US taxation for expats.

Common Forex Tax Reporting Mistakes

Many traders unknowingly make errors that can cost them money or attract IRS attention. Some of the most frequent mistakes include:

- Not reporting small gains and losses (the IRS requires full reporting, no matter the size).

- Forgetting to file FBAR when using foreign brokers.

- Confusing Section 988 with Section 1256 rules.

- Poor record-keeping (relying only on broker statements).

- Missing the deadline to make a Section 1256 election.

If you need help avoiding these errors, professional expat tax advice can ensure your forex trading income is accurately filed under the right IRS rules.